Dr. Henning Giese

Betriebswirtschaftslehre, insb. Betriebswirtschaftliche Steuerlehre

PostDoc

Research Assistant TRR 266 Accounting for Transparency (A05 - Accounting for Tax Complexity). Research Focus: Tax Complexity

- E-Mail:

- henning.giese@uni-paderborn.de

- Phone:

- +49 5251 60-2926

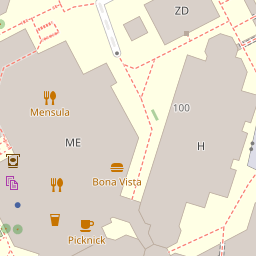

- Office Address:

-

Warburger Str. 100

33098 Paderborn - Room:

- Q5.131

- Office hours:

by appointment

Research

Publications

Selected Publications

Die Kriterien und Zusammensetzung der EU-Blacklist als Grundlage des Steueroasen-Abwehrgesetzes – Eine kritische Würdigung

L. Schön, B. Graßl, H. Giese, Steuer und Wirtschaft (2024) 71–92.

Where to Locate Tax Employees? The Role of Tax Complexity and Tax Risk Implications

H. Giese, R. Koch, C. Sureth-Sloane, Where to Locate Tax Employees? The Role of Tax Complexity and Tax Risk Implications, 2024.

The Effects of Tax Reform on Labor Demand within Tax Departments

H. Giese, D. Lynch, K.A. Schulz, C. Sureth-Sloane, The Effects of Tax Reform on Labor Demand within Tax Departments, 2024.

Towards Green Driving - Income Taxes Incentives for Plug-In Hybrids

H. Giese, S. Holtmann, Towards Green Driving - Income Taxes Incentives for Plug-In Hybrids, 2023.

Losses Never Sleep – The Effect of Tax Loss Offset on Stock Market Returns during Economic Crises

R. Koch, S. Holtmann, H. Giese, Journal of Business Economics 93 (2023) 59–109.

Show all publications

Further Information

Presentations

Mai 2025

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: The Effects of Tax Reform on Labor Demand within Tax Departments, Brown Bag Seminar Tax & Public Finance, Leibniz University Hannover, Hanover.

Giese, Henning/ Koch, Reinald/ Rehrl, Christoph: Real Effects of Earnings Stripping Rules, 2nd Ghent Conference on International Taxation, Ghent, Belgium.

April 2025

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: The Effects of Tax Reform on Labor Demand within Tax Departments, Indiana University, Bloomington, USA.

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: The Effects of Tax Reform on Labor Demand within Tax Departments, University of Kentucky, Lexington, USA.

March 2025

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: The Effects of Tax Reform on Labor Demand within Tax Departments, 2025 UNC Tax Symposium, UNC Kenan-Flagler Business School, Chapel Hill, USA.

February 2025

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: The Effects of Tax Reform on Labor Demand within Tax Departments, 37th Annual American Taxation Association Midyear Meeting, Dallas, USA.

Giese, Henning/ Koch, Reinald/ Rehrl, Christoph: (Un)Intended consequences of earnings stripping rules, 1st KU Research Institute for Taxation Conference, Ingolstadt.

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: The Effects of Tax Reform on Labor Demand within Tax Departments, 1st KU Research Institute for Taxation Conference, Ingolstadt.

Giese, Henning/ Koch, Reinald/ Rehrl, Christoph: (Un)Intended consequences of earnings stripping rules, Doctoral Tax Seminar, Mannheim.

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: The Effects of Tax Reform on Labor Demand within Tax Departments, TRR 266 Brown Bag Seminar, Frankfurt School of Finance, Frankfurt.

Dezember 2024

Giese, Henning/ Koch, Reinald/ Rehrl, Christoph: (Un)Intended consequences of earnings stripping rules, Tax Research Seminar, Paderborn University, Paderborn.

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: The Effects of Tax Reform on Labor Demand within Tax Departments, 2nd Tax Transparency Conference Research Workshop on the Latest in Tax Research, Bergen, Norway.

October 2024

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, ESE Accounting Research Retreat, Erasmus University Rotterdam, Rotterdam, The Netherlands.

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, Accounting Research Seminar, Texas Tech University, Lubbock, USA.

August 2024

Giese, Henning/Holtmann, Svea: Towards Green Driving? Income Tax Incentives for Plug-in Hybrids, Brown Bag Seminar, Facultyresearchworkshop, Pderborn University, Bad Arolsen, Deutschland.

Giese, Henning/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, Facultyresearchworkshop, Pderborn University, Bad Arolsen, Deutschland.

Giese, Henning/ Heinemann-Heile, Vanessa: The Influence of Trust and Salience on Firms' Willingness to Pay Taxes, Facultyresearchworkshop, Pderborn University, Bad Arolsen, Deutschland.

Giese, Henning/ Koch, Reinald/ Sureth-Sloane, Caren: Tax Complexity, Tax Department Structure, and Tax Risk, 80th Annual Congress of the International Institute of Public Finance, Prague, Czech Republic.

Giese, Henning: Taxes and The Location of Jobs Within Multinational Firms, Discussion of the Working Paper of Sarah Clifford and Irem Guceri, 80th Annual Congress of the International Institute of Public Finance, Prague, Czech Republic.

July 2024

Giese, Henning/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, 19th arqus annual meeting 2024, University of Graz, Graz, Austria.

Amberger, Harald/ Giese, Henning/ Koch, Reinald/ Ortner, Lukas: Tax Department Organization, Tax Planning, and Tax Risk, 14th EIASM Conference on Current Research in Taxation, Porto.

Giese, Henning: Firm-Level Tax Audit Enforcement: A Generative AI-Based Measurement, Discussion of the Working Paper of Alex Kim and Ga-Young Choi, 14th EIASM Conference on Current Research in Taxation, Porto.

June 2024

Amberger, Harald/ Giese, Henning/ Koch, Reinald/ Ortner, Lukas: Tax Department Organization, Tax Planning, and Tax Risk, Virtual Doctoral Tax Seminar, online.

Giese, Henning: Closing Pandora’s IP Box: The Impact of the Nexus Approach on Patent Shifting and Innovative Activity, Discussion of the Working Paper of Matti Boie-Wegener, Virtual Doctoral Tax Seminar, online.

May 2024

Giese, Henning/ Heinemann-Heile, Vanessa: The Influence of Trust and Salience on Firms' Willingness to Pay Taxes, European Accounting Association, 46th Annual Congress, Bukarest, Rumänien.

Giese, Henning/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, TAF Brown Bag Seminar, Universität Paderborn, Paderborn.

March 2024

Giese, Henning/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, Accounting Research Camp on Transparency In Corporations and markets (ARCTIC), Fügen, Austria.

February 2024

Giese, Henning: Carbon Leakage to Developing Countries, Discussion of the working paper of Diego Känzig, Julian Marenz und Marcel Olbert, The 36th Annual American Taxation Association (ATA) Midyear Meeting, Long Beach (LA), USA.

November 2023

Giese, Henning/ Holtmann, Svea: Towards Green Driving? Income Tax Incentives for Plug-in Hybrids, Brown Bag Seminar, University of Mannheim, Mannheim.

Giese, Henning/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, Brownbag in Tax & Financial Accounting, WHU - Otto Beisheim School of Management, Vallendar.

Giese, Henning: The Effect of Transfer Pricing Documentation Requirements on Tax Compliance Costs and Administrative Costs, Discussion of the working paper by Nadine Riedel, Katharina Schmidt, Johannes Voget and Sophia Wickel, TRR 266 Annual Conference 2023, University of Mannheim, Mannheim.

October 2023

Giese, Henning/ Holtmann, Svea: Towards Green Driving - Income Tax Incentives for Plug-In Hybrids, Brownbag in Tax & Financial Accounting, WHU - Otto Beisheim School of Management, Vallendar.

Giese, Henning/ Koch, Reinald/ Sureth-Sloane, Caren: Tax Complexity, Tax Department Structure, and Tax Risk, 3rd Dutch Workshop on Corporate Taxation, Erasmus University Rotterdam, Rotterdam, Netherlands.

September 2023

Giese, Henning/ Koch, Reinald/ Sureth-Sloane, Caren: Tax complexity, tax department structure, and tax risk, Herbsttagung der Kommission Betriebswirtschaftliche Steuerlehre im VHB e.V., Catholic University Eichstätt-Ingolstadt, Ingolstadt.

Giese, Henning/ Holtmann, Svea: Towards Green Driving - Income Tax Incentives for Plug-In Hybrids, 10th Annual MannheimTaxation Conference, ZEW, Mannheim.

Giese, Henning: Withheld from Working More? Withholding Taxes and the Labor Supply of Married Women, Discussion of the Working Paper of Tim Bayer, Lenard Simon and Jakob Wegmann, 10th Annual MannheimTaxation Conference, ZEW, Mannheim.

July 2023

Giese, Henning/ Heinemann-Heile, Vanessa/ Sureth-Sloane, Caren: The Influence of Trust and Salience on Firms´ Acceptance of Tax Rates, 18th arqus annual meeting 2023, Julius-Maximilians-Universität of Würzburg, Würzburg (accepted).

June 2023

Giese, Henning: Competition Laws and Corporate Tax Avoidance: International Evidence, Discussion of the Working Paper of Taejin Jung, Sunhwa Choi, Jaehee Jo and Hee-Yeon Sunwoo, 2023 CAAA Annual Conference, Québec City, Canada.

Giese, Henning/ Holtmann, Svea: Towards Green Driving - The Effect of Tax Incentives on the Registration of Plug-in Hybrids, 2023 CAAA Annual Conference, Québec City, Canada.

May 2023

Giese, Henning: Tax Treaties, Tax-Motivated Income Shifting, and the Role of Enforcement, Discussion of the Working Paper of Malte Martin Max, European Accounting Association, 45th Annual Congress, Helsinki-Espoo, Finland.

Giese, Henning: Tax Evasion Penalties and Aggressive Tax Avoidance, European Accounting Association, 45th Annual Congress, Helsinki-Espoo, Finland.

Giese, Henning/ Schipp, Adrian: Autocrats, Democrats and Law Simplification – The Case of Tax Complexity, European Accounting Association, 45th Annual Congress, Helsinki-Espoo, Finland.

Giese, Henning: War for talent: How do tax incentives for foreigners affect local workforce?, TAF Brown Bag Seminar, Paderborn University, Paderborn.

January 2023

Giese, Henning/ Koch, Reinald/ Sureth-Sloane, Caren: Tax complexity, tax department structure, and tax risk, TRR Brown Bag 2023, WHU – Otto Beisheim School of Management.

December 2022

Giese, Henning/ Schipp, Adrian: Autocrats, Democrats and Law Simplification – The Case of Tax Complexity, TAF Brown Bag Seminar, Paderborn University, Paderborn.

November 2022

Giese, Henning/ Koch, Reinald/ Sureth-Sloane, Caren: Tax complexity and tax department structure: The hidden cost of complex tax systems, TRR 266 Annual Conference 2022, Ludwigs-Maximilians-Universität München, Munich.

Giese, Henning/ Koch, Reinald/ Sureth-Sloane, Caren: Tax complexity and tax department structure: The hidden cost of complex tax systems, 115th Annual Conference on Taxation, National Tax Association, Miami, USA (accepted).

September 2022

Giese, Henning/ Koch, Reinald/ Sureth-Sloane, Caren: Tax complexity and tax department structure: The hidden cost of complex tax systems, 5th Biennial Taxation Research Symposium, Toronto, Canada.

Giese, Henning/ Koch, Reinald/ Sureth-Sloane, Caren: Tax complexity and tax department structure: The hidden cost of complex tax systems, Arbeitskreis Steuern of the Schmalenbach-Gesellschaft e.V., Baker McKenzie, Frankfurt, Germany.

Giese, Henning/ Schipp, Adrian: Political Polarization and Tax Complexity, Faculty Research Workshop, Paderborn University, Melle.

Giese, Henning/ Holtmann, Svea: Towards Green Driving - The Effect of Tax Incentives on the Registration of Plug-in Hybrids, Poster presentation at Workshop Data Society. Chancen – Innovationen – Verantwortung (50 Jahre UPB), Paderborn University, Germany.

Giese, Henning/ Koch, Reinald/ Sureth-Sloane, Caren: Tax complexity and tax department structure: The hidden cost of complex tax systems, 9th Annual MannheimTaxation Conference, University of Mannheim, Mannheim.

July 2022

Giese, Henning/ Schipp, Adrian: Political Polarization and Tax Complexity, 17th arqus annual meeting 2022, Otto-von-Guericke-University Magdeburg, Magdeburg.

Giese, Henning/ Heinemann-Heile, Vanessa: The Influence of Trust and Salience on Firms´ Acceptance of Tax Rates, 17th arqus annual meeting 2022, Otto-von-Guericke-University Magdeburg, Magdeburg.

May 2022

Giese, Henning/ Koch, Reinald/ Sureth-Sloane, Caren: Tax complexity and tax department structure: The hidden cost of complex tax systems, European Accounting Association, 44th Annual Congress, Bergen, Norway.

Koch, Reinald/ Holtmann, Svea/ Giese, Henning: Losses Never Sleep – The Effect of Tax Loss Offset on Stock Market Returns during Economic Crises, European Accounting Association, 44th Annual Congress, Bergen, Norway.

March 2022

Giese, Henning/ Holtmann, Svea: Towards Green Driving - The Effect of Tax Incentives on the Registration of Plug-in Hybrids, 83rd VHB Annual Conference.

Giese, Henning/ Koch, Reinald: The Effect of Tax Department Structure on Tax Avoidance and Tax Risk, 83rd VHB Annual Conference.

January 2022

Giese, Henning/ Holtmann, Svea: Towards Green Driving - The Effect of Tax Incentives on the Registration of Plug-in Hybrids, 5th Vienna Doctoral Consortium, WU Vienna, Vienna, Austria.

September 2021

Giese, Henning/ Holtmann, Svea: Towards Green Driving - The Effect of Tax Incentives on the Registration of Plug-in Hybrids, 7th Berlin-Vallendar Conference on Tax Research, Berlin.

August 2021

Giese, Henning/ Koch, Reinald: The effect of tax department structure on tax avoidance and tax risk, IIPF 77th Annual Congress, University of Iceland, Reykjavík, Iceland.

Giese, Henning/ Koch, Reinald: The effect of tax department structure on tax avoidance and tax risk, AAA 105th Annual Meeting.

July 2021

Giese, Henning/ Holtmann, Svea: Towards Green Driving - The Effect of Tax Incentives on the Registration of Plug-in Hybrids, 16. arqus-Jahrestagung 2021, University of Magdeburg, Magdeburg.

May 2021

Giese, Henning/ Koch, Reinald: The effect of tax department structure on tax avoidance and tax risk, EAA 1st Virtual Congress.

Giese, Henning/ Koch, Reinald: The effect of tax department structure on tax avoidance and tax risk, TRR 266/TAF Research Seminar, Paderborn University, Paderborn.

May 2020

Giese, Henning/ Gamm, Markus/ Koch, Reinald: Tax avoidance and the use of joint managers within multinational enterprises, 36th EAA Doctoral Colloquium in Accounting, Bucharest, Romania (accepted).

March 2020

Gamm, Markus/ Giese, Henning/ Koch, Reinald: Tax avoidance and the use of joint managers within multinational enterprises, VHB Jahrestagung 2020, Frankfurt.

November 2018

Gamm, Markus/ Giese, Henning/ Koch, Reinald: Tax avoidance and the use of joint managers within multinational enterprises, 4th Vienna Doctoral Consortium in Taxation, WU Vienna, Vienna, Austria.

September 2018

Gamm, Markus/ Giese, Henning/ Koch, Reinald: Tax avoidance and the use of joint managers within multinational enterprises, Annual Doctoral Conference of the Oxford University Centre for Business Taxation, Saïd Business School, Oxford, United Kingdom.

July 2018

Gamm, Markus/ Giese, Henning/ Koch, Reinald: Tax avoidance and the use of joint managers within multinational enterprises, 8th EIASM Conference on Current Research in Taxation, Muenster.

May 2018

Gamm, Markus/ Giese, Henning/ Koch, Reinald: Tax avoidance and the use of joint managers within multinational enterprises, 41st Annual Congress of the European Accounting Association, Milano, Italy.