Kim Alina Schulz

Betriebswirtschaftslehre, insb. Betriebswirtschaftliche Steuerlehre

Research Associate

PhD Student & Research Assistant TRR 266 Accounting for Transparency (A05 - Accounting for Tax Complexity; B01 - Investment Effects of Taxation). Research Focus: Tax Complexity and Tax Compliance

- E-Mail:

- kim.alina.schulz@uni-paderborn.de

- Phone:

- +49 5251 60-1788

- Web:

- Homepage (Extern)

-

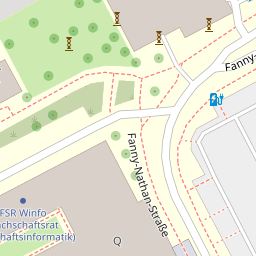

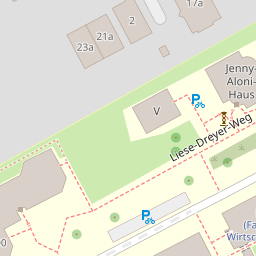

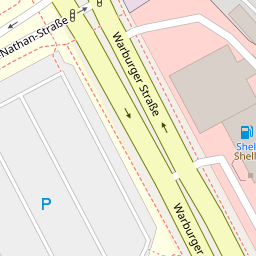

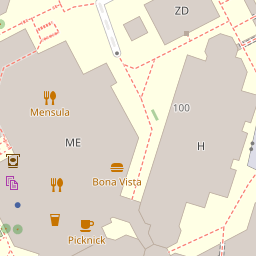

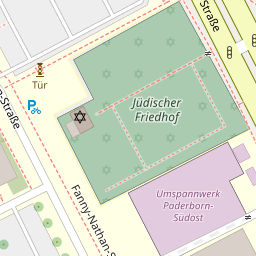

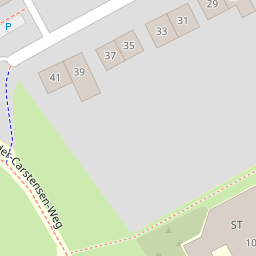

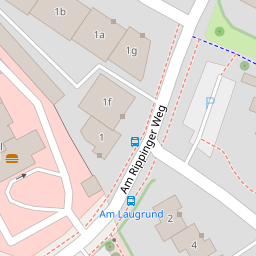

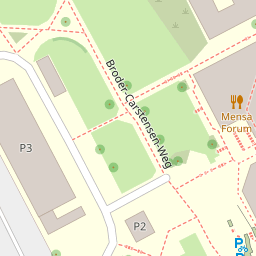

- Office Address:

-

Warburger Str. 100

33098 Paderborn - Room:

- Q5.334

- Office hours:

Upon prior arrangement.

About Kim Alina Schulz

Curriculum Vitae

Since 28.05.2023: PhD

Business Taxation

10/2020 - 20.04.2023: Master Studies

M.Sc. Taxation, Accounting and Finance, Paderborn University

10/2017 - 08/2020: Bachelor Studies

B.Sc. Business Administration and Economics, Paderborn University

08.04.2025: Best Paper Award and Cedric Sandford Medal at the 16th International ATAX Tax Administration Conference

Greil, S., Kaluza-Thiesen, E., Schulz, K. A., & Sureth-Sloane, C. (2025). Avenues to Attenuate Transfer Pricing Complexity and Enhance Compliance – Survey

Research

Research Interests

Tax Complexity and Tax Compliance

Publications

Selected Publications

The Effects of Tax Reform on Labor Demand within Tax Departments

H. Giese, D. Lynch, K.A. Schulz, C. Sureth-Sloane, The Effects of Tax Reform on Labor Demand within Tax Departments, 2024.

Tax Compliance Management Systeme in deutschen Betriebsprüfungen – Eine Analyse praktischer Erfahrungen

K.A. Schulz, C. Sureth-Sloane, Steuer und Wirtschaft 101 (2024) 335–353.

Show all publications

Further Information

Presentations

July 2025

Schulz, Kim Alina. The Effects of Tax Compliance Management Systems on Tax Risk, 20. arqus Annual Meeting 2025, Freie Universität Berlin, Berlin.

May 2025

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: The Effects of Tax Reform on Labor Demand within Tax Departments, 47th European Accounting Association Annual Congress, Rome, Italy.

April 2025

Greil, Stefan/ Kaluza-Thiesen, Eleonore/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Avenues to attenuate transfer pricing complexity and enhance compliance – Survey evidence, 16th International ATAX Tax Administration Conference, University of New South Wales, Sydney, Australia.

February 2025

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: The Effects of Tax Reform on Labor Demand within Tax Departments, 37th Annual American Taxation Association Midyear Meeting, Dallas, USA.

Giese, Henning/ Lynch, Dan/ Schulz, Kim Alina/ Sureth-Sloane, Caren: The Effects of Tax Reform on Labor Demand within Tax Departments, TRR 266 Brown Bag Seminar, Frankfurt School of Finance, Frankfurt.

November 2024

Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Compliance Management Systeme in deutschen Betriebsprüfungen – Eine Analyse praktischer Erfahrungen, Bertelsmann GBS Conference, Gütersloh.

September 2024

Greil, Stefan/ Kaluza-Thiesen, Eleonore/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Avenues to attenuate transfer pricing complexity and enhance compliance – Survey evidence, 33rd Annual Tax Research Network Conference, University of Cardiff, Cardiff, Wales

August 2024

Giese, Henning/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, Facultyresearchworkshop 2024, Paderborn University, Bad Arolsen.

July 2024

Giese, Henning/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, 19th arqus annual meeting 2024, University of Graz, Graz, Austria.

May 2024

Giese, Henning/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, TAF Brown Bag Seminar, Paderborn University, Paderborn.

March 2024

Giese, Henning/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, Accounting Research Camp on Transparency In Corporations and markets (ARCTIC), Fügen, Austria.

November 2023

Giese, Henning/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Reforms and Firms’ Demand for Tax Talents, Brownbag in Tax & Financial Accounting, WHU - Otto Beisheim School of Management, Vallendar.

Greil, Stefan/ Kaluza-Thiesen, Eleonore/ Schulz, Kim Alina/ Sureth-Sloane, Caren: Tax Compliance and Transfer Pricing, Faculty Research Workshop, Postersession, Paderborn University, Paderborn.

July 2023

Schulz, Kim Alina: Tax Compliance Management Systeme in deutschen Betriebsprüfungen, 18th arqus annual meeting 2023, Julius-Maximilians-Universität of Würzburg, Würzburg.