Dr. Reyhaneh Safaei

Betriebswirtschaftslehre, insb. Betriebswirtschaftliche Steuerlehre

Former

PhD Student & Research Assistant TRR 266 Accounting for Transparency (A05 - Accounting for Complexity; B01- Investment Effects of Taxation). Research Focus: Tax Audits & Compliance, Transfer Pricing

- E-Mail:

- reyhaneh.safaei@uni-paderborn.de

- Phone:

- +49 5251 60-1788

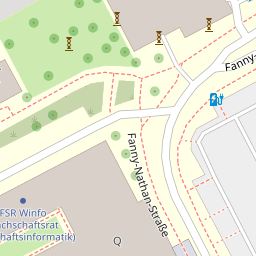

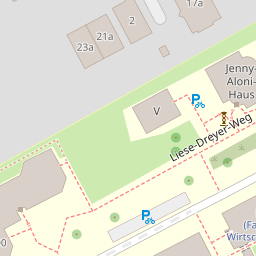

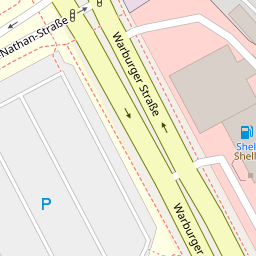

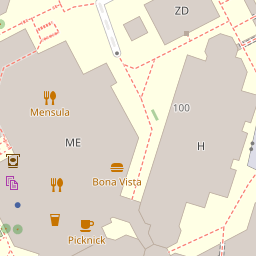

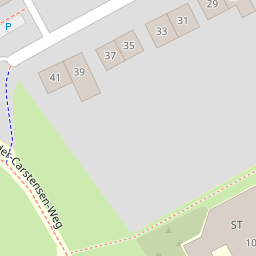

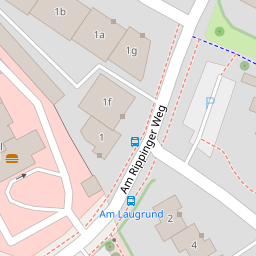

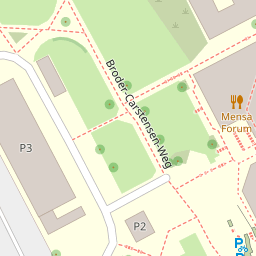

- Office Address:

-

Warburger Str. 100

33098 Paderborn - Room:

- Q5.334

Publications

Latest Publications

Transfer Pricing Rules for Intangibles: Implementation and Practical Challenges

R. Safaei, Transfer Pricing Rules for Intangibles: Implementation and Practical Challenges, 2022.

Changes in Transfer Pricing Regulations and Corporate Investment Decisions

M.A. Shabestari, R. Safaei, Changes in Transfer Pricing Regulations and Corporate Investment Decisions, 2022.

Are Risk-based Tax Audit Strategies Rewarded? An Analysis of Corporate Tax Avoidance

E. Eberhartinger, R. Safaei, C. Sureth-Sloane, Y. Wu, Are Risk-Based Tax Audit Strategies Rewarded? An Analysis of Corporate Tax Avoidance, TRR 266 Accounting for Transparency Working Paper Series No. 60, 2021.

Are Risk-based Tax Audit Strategies Rewarded? An Analysis of Corporate Tax Avoidance

E. Eberhartinger, R. Safaei, C. Sureth-Sloane, Y. Wu, TRR 266 Accounting for Transparency Working Paper Series No. 60, WU International Taxation Research Paper Series No. 2021-07 (2021).

Tax Complexity for Multinational Corporations in South Africa - Evidence from a Global Survey

T. Hoppe, R. Safaei, A. Singleton, C. Sureth-Sloane, in: C. Evans, R. Franzsen, E. Stack (Eds.), Tax Simplification - An African Perspective, Pretoria University Law Press, Pretoria, 2019, pp. 267–293.

Show all publications